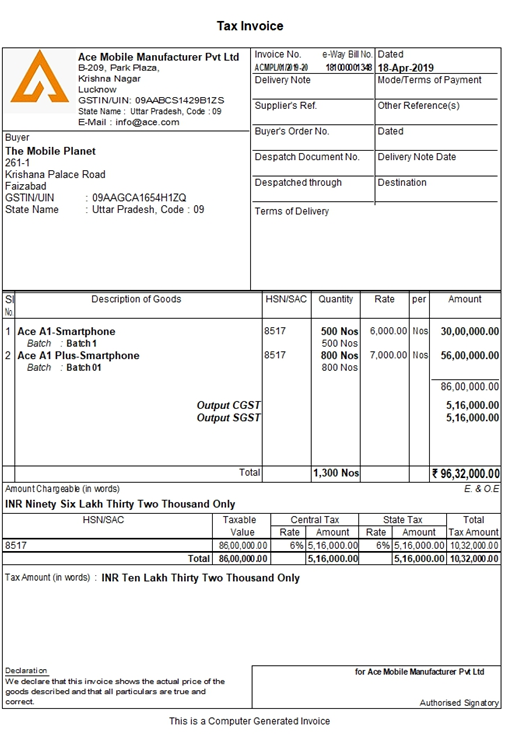

On this, some goods and services are exempted from GST. In Singapore, there exist three types of supplies which are exempted from GST. Organizations that have already met some conditions are required to submit the application to IRIS in order to be registered by the GST before they are given the go-ahead to charge and' collect GST. The companies which are incorporated in Singapore do not get an automatic registration to charge the GST. The invoiced amount of GST which is collected for the tax authorities from the customers should subsequently be submitted to the tax department of Singapore quarterly through filling the GST returns. For example, in a situation where you charge $100 for the services to the customers living in Singapore, you need to invoice the customers $107 such that the $100 goes for the services and the GST of 7%.

If you have a company that is GST registered, you have a responsibility of collecting the GST from different customers for the services and goods supplied to you and then provide tax you have collected to the tax authorities. The GST is imposed to the end consumer, this, therefore, ensures GST doesn't become costly to the company. It is an indirect tax which is usually expressed as a percentage and it is applied to the selling price of the good and services offered by the business organization registered under GST in Singapore.

The truth of the matter is that there is no VAT charged on the invoice and there will be no VAT that will be collected from the client.Īlso referred to as the Value Added Tax, in several other countries, Goods and Service Tax (GST) refers to consumption tax, which is usually levied on the goods and services supplied in Singapore. VAT Supplies which are Zero Rated - The business registered with VAT, and at the same time making zero-rated supplies charge a VAT of 0% on the price set for selling.In actual sense, the VAT is usually included on the list items by following the schedule of the VAT. The VAT on the standard-rated supplies - When taxable supplies are made, the businesses registered on VAT, gather VAT from their clients, regarding the sales, and they have a responsibility to remit to the SRC.How is Value Added Tax (VAT) Applicable on a Taxable Supply? The other one is the zero rate at 0% which is applicable to the exports and specific list of commodities following the schedule of the VAT. They include the standard rate which goes at 15% and it is applicable to different goods and services which are mostly imported and sold. Taxable means that the VAT is imposed on the transactions. The importation of the taxable goods can also be referred to as the taxable supply. For the VAT reasons, the taxable supply refers to the sale of taxable goods or the delivery of taxable services.

0 kommentar(er)

0 kommentar(er)